Earn products are central to how users deposit tokens and earn yield in DeFi.

This article explains how Merkl enables smarter incentive campaigns for Earn products, helping wallets, exchanges and web3 teams launch and distribute rewards efficiently, without unnecessary complexity or wasted budget.

Wallet incentive models with Merkl

Merkl enables two distinct integration models for wallets looking to enhance user yields or partner with DeFi protocols:

1. Tailored rewards for wallet users

Merkl enables wallets to run campaigns that directly reward their users while keeping full control over the incentive strategy.

It automatically calculates rewards and supports flexible boosting rules based on onchain data (wallet balance, transaction history, etc), and offchain criteria (user tier, geographic location, or KYC status, etc). This allows wallets to create tailored experiences, for example offering premium users higher yields or targeting specific user segments with customized incentives.

Use case: A wallet wants to reward its most active users with bonus yields on stablecoin deposits. Merkl ensures higher rewards are given to users who maintain larger balances or hold the wallet’s native token, creating a personalized and engaging experience.

2. Rewards that scale with user activity

Merkl enables performance-based partnerships between wallets and protocols, where incentive spend scales with actual user adoption.

A protocol can promise an extra X% APR to users coming from a specific wallet, within a fixed budget. Merkl continuously tracks how much liquidity those wallet users actually bring to the protocol and calculates exactly how much rewards are required to deliver the promised APR. If participation is lower than expected, the protocol automatically spends less.

Incentives always scale with real usage.

Merkl acts as a neutral settlement layer between wallets and protocols. It handles all onchain calculations and reward distributions, removing the need for manual tracking or trust assumptions between the wallet and protocol.

Use case: A protocol sets a $100k incentive budget to offer wallet users an extra 5% APR on a DEX liquidity pool. This budget would be fully used if wallet users supplied $2M in liquidity. If they instead supply only $500k, Merkl automatically adjusts the incentives so the protocol spends $25k, while wallet users still receive the full 5% APR.

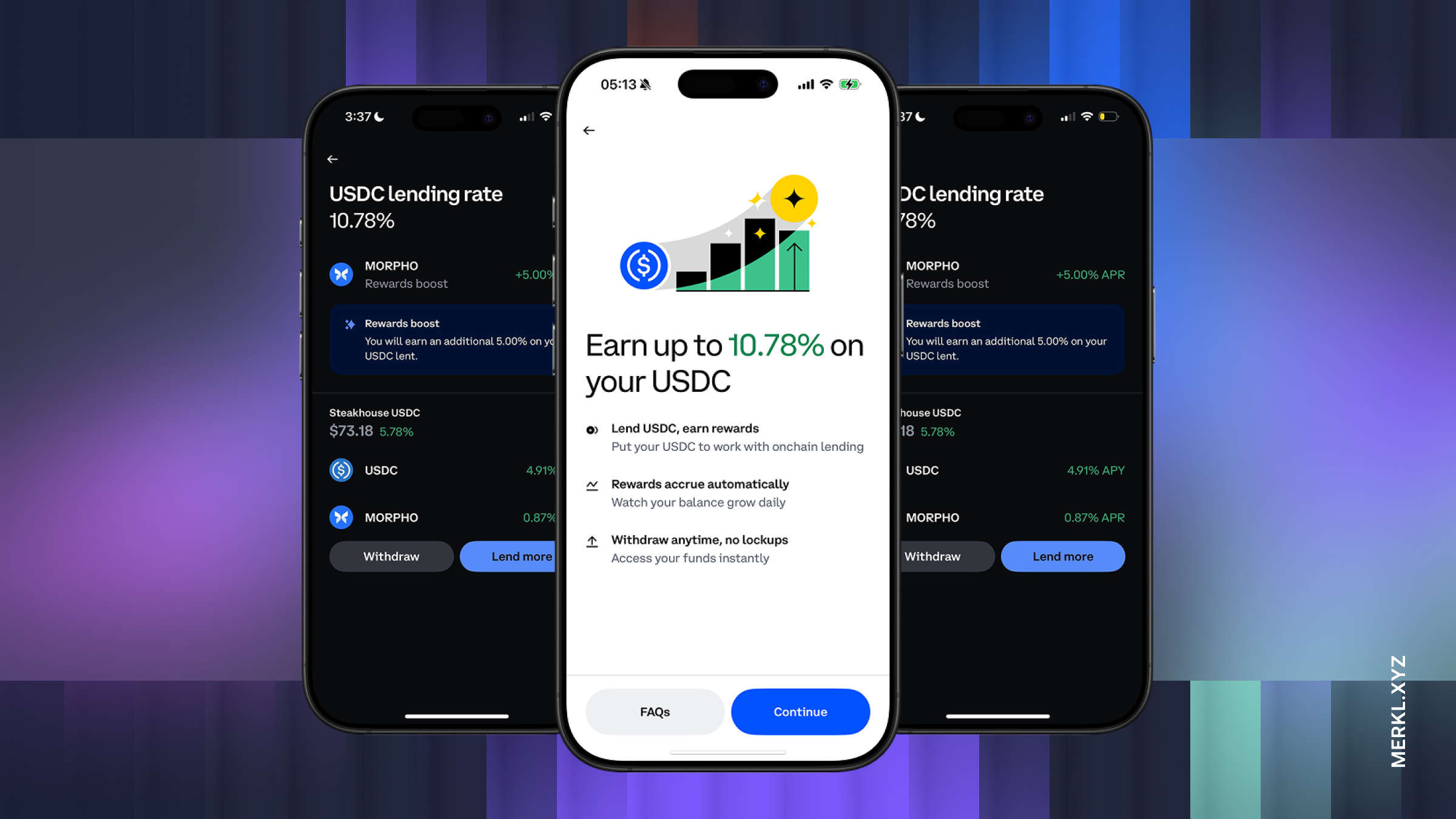

Coinbase Earn, powered by Merkl

Merkl’s incentive distribution options

Merkl offers three distinct approaches to distribute incentives, each with unique mechanics and tradeoffs. Choose based on your priorities around user experience, token economics, and technical integration requirements.

1. Direct distribution

Distribute incentive tokens directly to users' wallets. Users either claim rewards manually or receive them via daily auto-claiming.

Advantages:

- Clear reward visibility: users see exactly what they've earned

- Claim mechanics highlight the extra rewards, increasing engagement

- Reduced sell pressure since tokens aren't automatically converted

- Flexible boosting based on onchain or offchain metrics (e.g., higher yields for specific user segments like Revolut Metal members)

Tradeoffs:

- Requires frontend integration to enable claiming functionality

- Users receive multiple tokens, increasing wallet management complexity

- With auto-claiming enabled, users may be confused by unexpected tokens appearing in their wallets

- In countries where crypto transfers are taxed, the claiming tokens can be considered a taxable event

2. Vault auto-compound

Rewards flow to the vault contract, where the vault provider periodically claims, sells incentive tokens, and compounds them back into the principal asset.

Advantages:

- Zero frontend changes needed: simply display the boosted APR provided by the vault

- Completely passive for users: no actions required to earn enhanced yield

Tradeoffs:

- Creates systematic sell pressure on the incentive token through regular conversions

- No ability to implement user-specific boosting based on external criteria

3. Merkl auto-compound

The incentive budget purchases vault shares upfront, which are then distributed directly to users with auto-claiming enabled.

Advantages:

- Zero frontend changes needed: simply display the boosted APR provided by the vault

- Completely passive for users: no actions required to earn enhanced yield

- Supports user-specific boosting based on on-chain or off-chain metrics, just like direct distribution

Tradeoffs:

- Entire incentive budget is converted to vault shares at campaign launch, creating immediate selling pressure

- In countries where crypto transfers are taxed, the claiming tokens can be considered a taxable event

Merkl gives wallets, exchanges, and web3 teams flexible tools to run incentive campaigns for Earn products. Whether creating tailored rewards or performance-based incentives, Merkl makes it simple to engage users, maximize yields, and manage token economics efficiently.