Merkl is the leading incentive and points management platform in DeFi, enabling web3 projects to reward users who actively contribute to their growth.

Whether you’re just starting out in DeFi as a user or already managing incentive programs as a protocol, this article breaks down what Merkl is and how it works across three levels of expertise (beginner, intermediate, and advanced) exploring everything from its intuitive interface and innovative features to the underlying Merkl Engine and Distribution Creator contract.

By exploring Merkl at each level, you can grasp its full potential and see how it’s transforming the way users and DeFi teams engage with crypto rewards.

Beginner: Merkl 101

For users

For newcomers to DeFi, Merkl is best understood as a hub for earning crypto rewards, whether in tokens or points.

Users can participate in a variety of activities (providing liquidity in a pool or a vault, lending & borrowing assets, holding tokens, and more) and receive rewards in return.

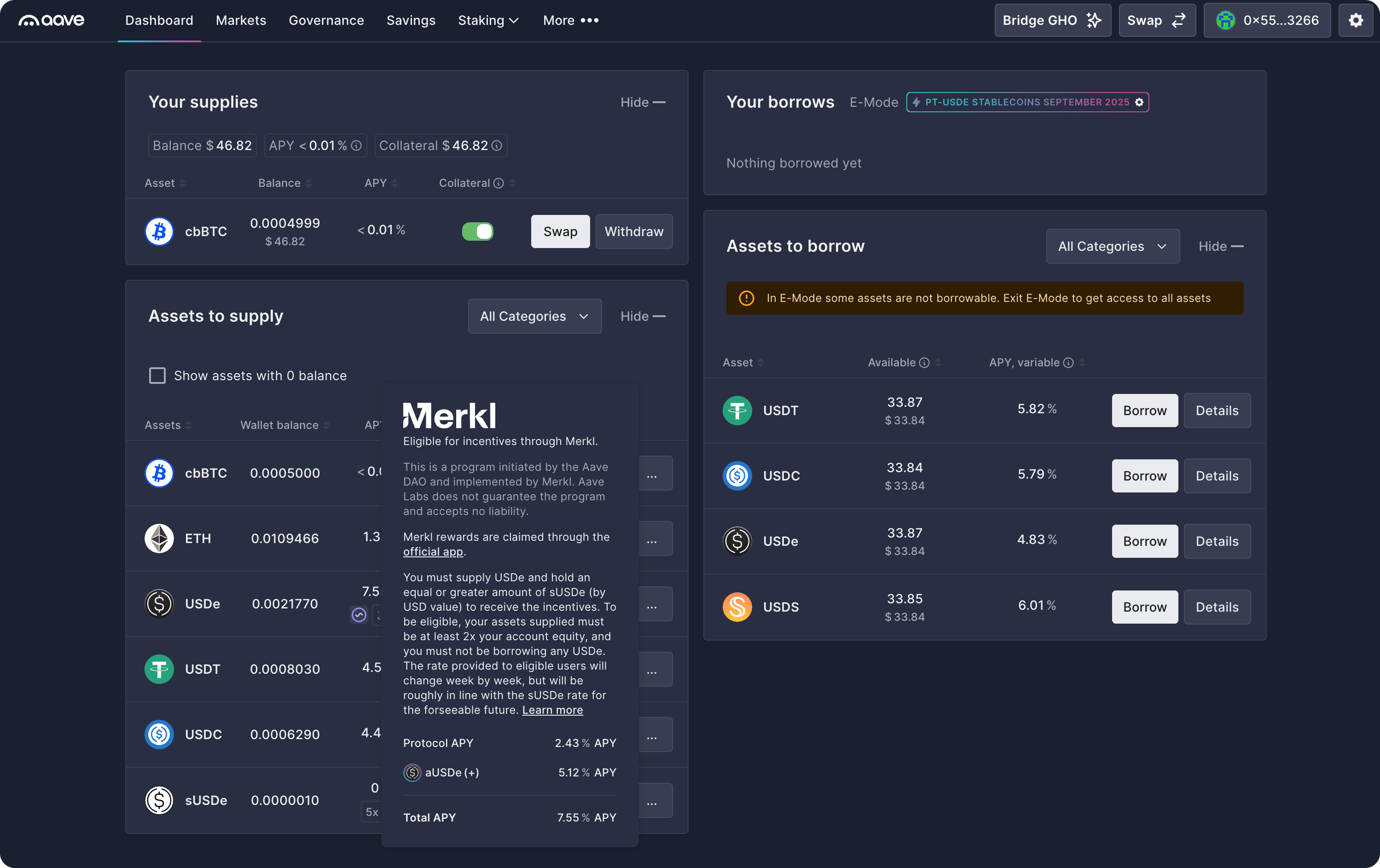

The experience is designed to be simple and secure: users interact directly with their favorite protocols (Aave, Uniswap, Morpho,…), while the Merkl Engine tracks their activity and calculates their rewards, turning everyday actions into rewarding opportunities without the need for complex staking, locking mechanisms, or tedious quests.

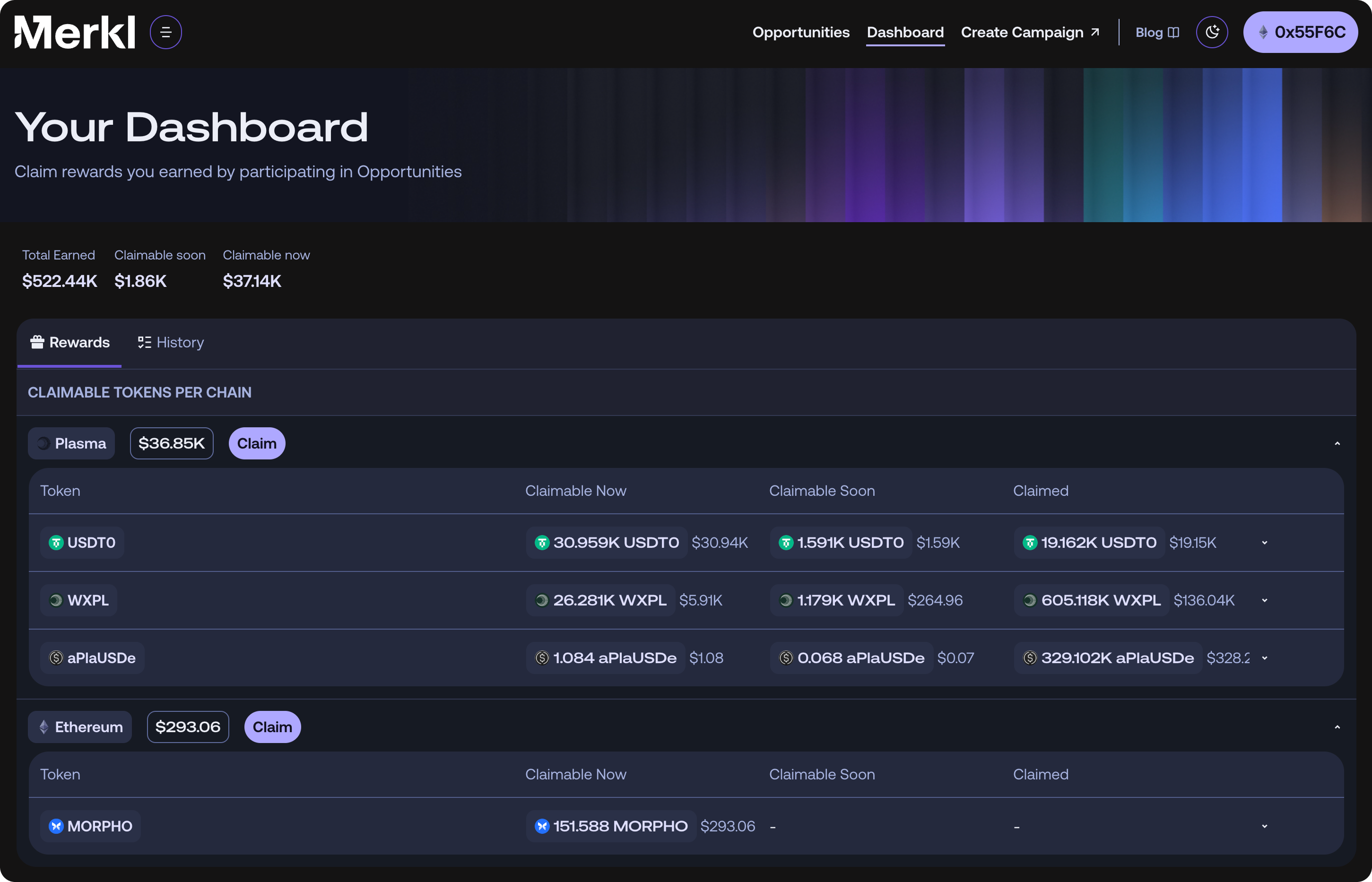

All active reward campaigns are accessible through the Merkl App, which provides a clear leaderboard and an intuitive dashboard where users can track and claim their earnings.

But where do these rewards actually come from?

While Merkl handles the distribution, the rewards originate from the protocols themselves, which allocate them to drive activity on their apps. It’s a win-win system: users perform desired actions, and protocols reward them in return.

For protocols

From a protocol or chain perspective, Merkl serves as a turnkey solution for launching incentive programs and boosting user engagement.

Instead of building an in-house infrastructure to track user engagement and distribute incentives accordingly, web3 projects can easily define campaign parameters (eligibility criteria, reward structure, budget, and more) and send the funds to be distributed to Merkl, which automates the operational workload. This allows teams focus on their core product while still driving growth, liquidity, and user engagement.

In essence, Merkl acts as a bridge connecting protocols that want to attract liquidity with users ready to provide assets in exchange for incentives.

Leading projects across the ecosystem, from DeFi protocols and blockchains to centralized exchanges and wallets, trust Merkl to power their incentive programs, including Aave, Arbitrum, Ethena, Morpho, Plasma, Société Générale–Forge, Trust Wallet, Uniswap, and others.

Intermediate: Exploring Merkl

For users

For more experienced Defi users, Merkl is a platform that simplifies yield farming and streamlines the liquidity provision (LP) experience.

At its core, the Merkl app is the place where users can view and access all reward campaigns in a single interface. It acts like a search engine for yield, gathering hundreds of earning opportunities across DeFi so users can easily find where rewards are being distributed without having to switch between multiple apps or constantly follow updates on X (Twitter).

Using Merkl doesn’t require any extra steps: no staking, no vesting, no locking of funds. Users simply interact with their favorite DeFi protocols as they normally would, while Merkl tracks onchain activity and automatically attributes the corresponding rewards. The platform is non-custodial, meaning users always keep control over their assets and face no additional smart contract risk beyond the one from the protocols they use.

Another key aspect of Merkl is co-incentivization: several campaigns can reward the same onchain action. For example, by providing USDT liquidity in an Uniswap pool, users could receive rewards both from the stablecoin issuer and from Uniswap itself - all visible and claimable through Merkl.

Rewards are calculated roughly every 2 hours and distributed onchain every 8 hours, creating a steady flow of incentives. Users can also batch-claim their rewards per chain in a single transaction, saving on gas fees and keeping the process simple and efficient.

In short, Merkl is the layer that connects users with DeFi rewards, making yield farming clearer, easier, and more accessible.

For protocols

For web3 teams, Merkl provides the infrastructure to create, manage, and track incentive and point campaigns across DeFi. It provides the technological foundation that enables protocols, chains, or wallets to design and execute reward mechanisms in a transparent, customizable, and fast way.

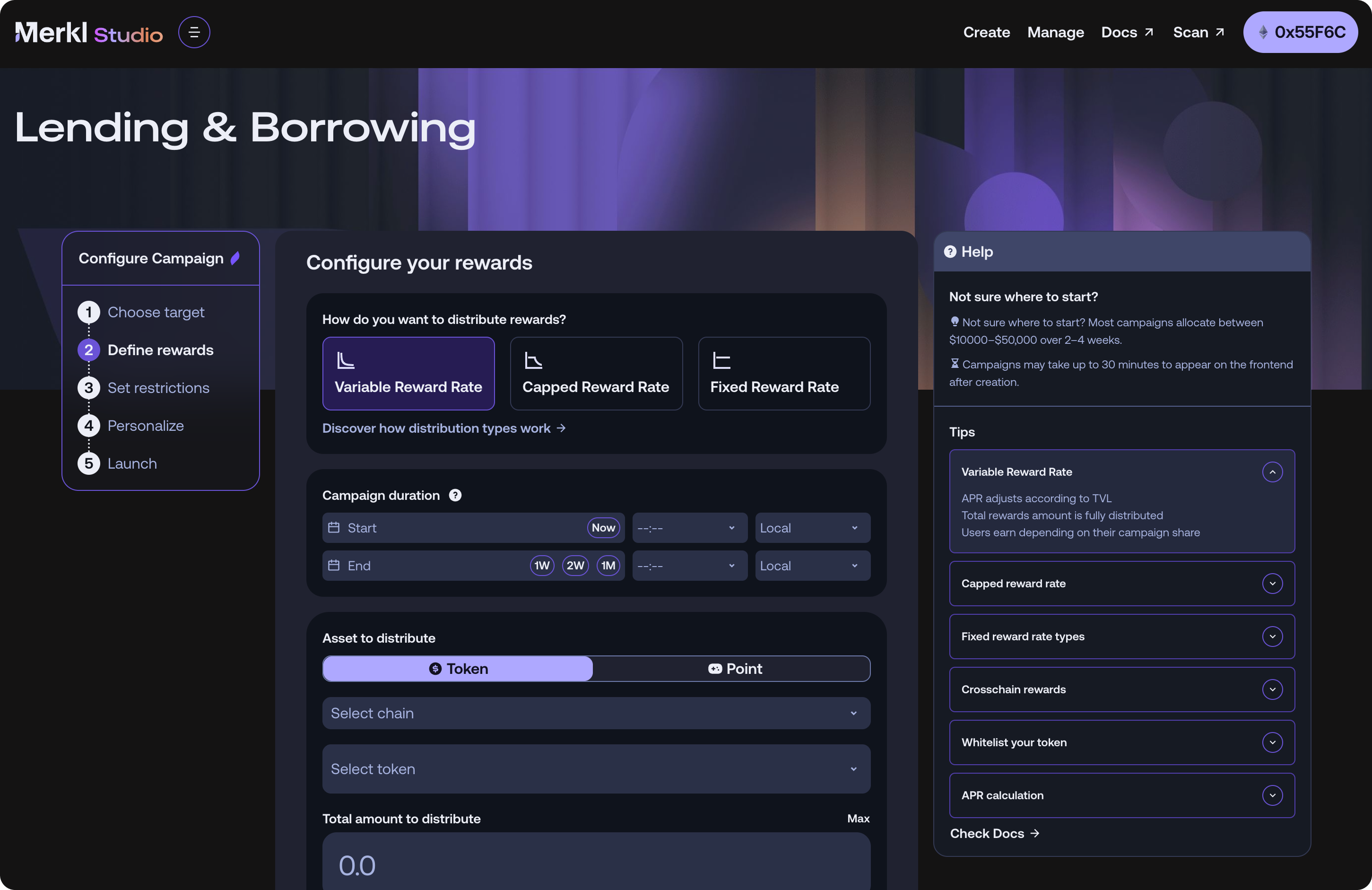

At its core, Merkl is a highly flexible system for building incentive campaigns. DeFi teams can configure rewards using different distribution types (fixed, variable, or capped reward rates) and add eligibility filters, boosts, referral mechanisms, and other options to create unique mechanisms and fully customize their reward campaigns.

Merkl also supports cross-chain incentives, allowing rewards to be distributed on a different chain from where the activity occurs. For example, a campaign could incentivize USD stablecoin deposits on Aave on the Base network, while distributing OP tokens as rewards on the Optimism mainnet network.

A foundational cornerstone of Merkl’s technology is reward forwarding: a mechanism ensuring that rewards go to the actual asset owners, even when their assets are held in a smart contract rather than directly in their wallet. This guarantees accurate and fair reward distribution across complex onchain interactions.

Beyond reward distribution, Merkl also serves as an incentive creation and management environment. With Merkl Studio, any web3 team can easily create, customize, and monitor campaigns through a dedicated interface, managing everything from setup to live adjustments.

In essence, Merkl is the underlying infrastructure that powers DeFi incentives, a system designed to make onchain reward distribution fair, scalable, and efficient.

Advanced: Mastering Merkl

For users

At the advanced level, Merkl can be best understood as a powerful engine (the Merkl Engine) driving all reward calculations and distributions.

Rewards are not simply handed out; at fixed intervals (approximately every 2 hours), the Merkl Engine indexes onchain activity, analyzing and storing all data for each address interacting with the incentivized asset, and calculates rewards based on the rules of each campaign. At this stage, rewards appear as pending in the Merkl App dashboard: users can see them, but cannot claim them yet.

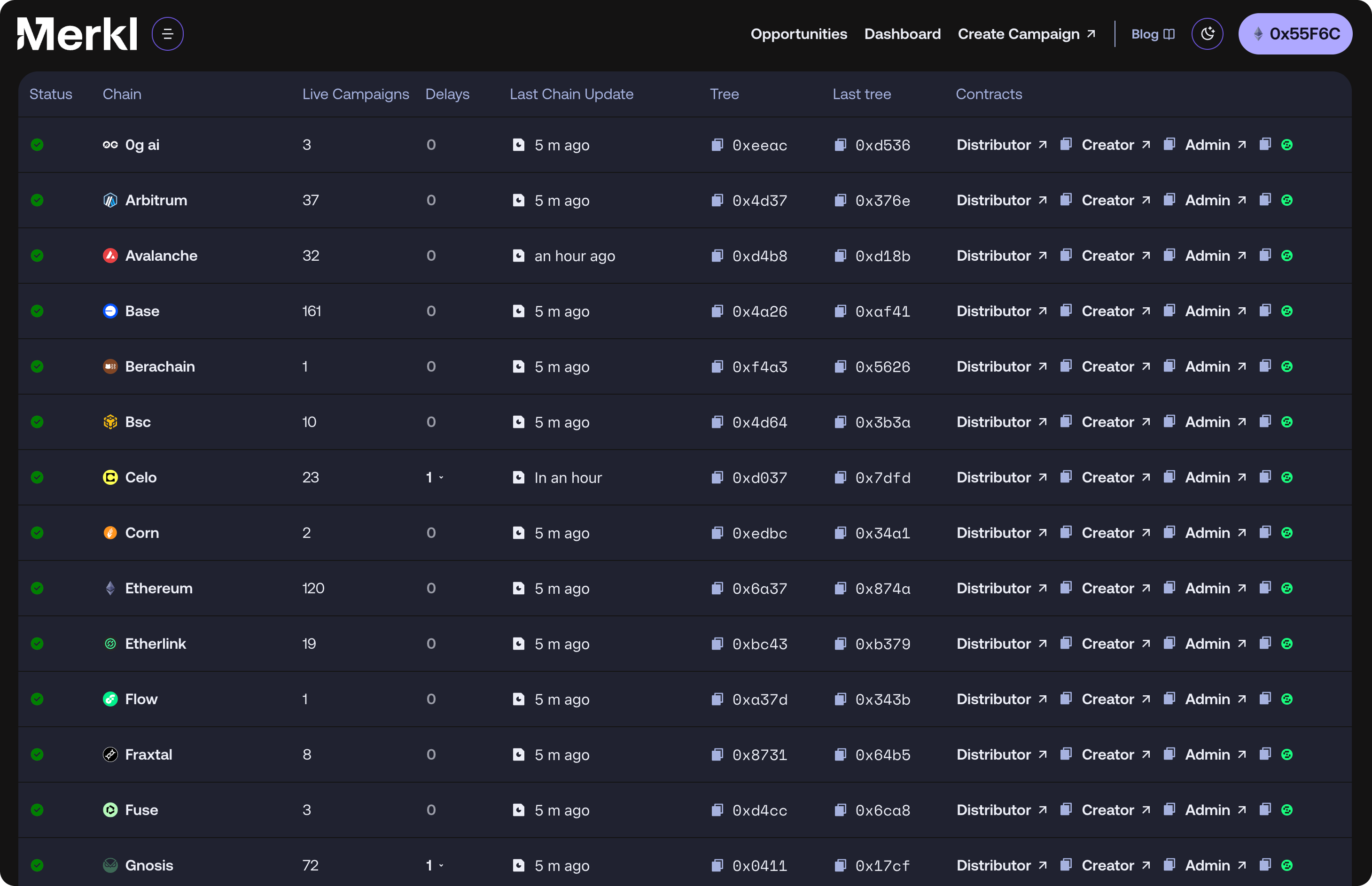

These calculations are then organized into a Merkle tree, compressed into a Merkle root, and pushed onchain, making the rewards claimable. This reward update occurs approximately every 8 hours.

There is one Merkle root per chain on which rewards are distributed - this explains why users can batch-claim all their rewards per chain in a single transaction!

It is important to distinguish reward computation (i.e., when the Merkl Engine calculates reward allocations based on campaign rules) from reward update (i.e., when calculated rewards are posted onchain, and then become claimable by users).

All reward calculations in Merkl are continuously monitored with multiple checks to prevent misdistribution. If an invariant is triggered or if third-party data is temporarily unavailable, computations are automatically paused. Once the necessary data is restored, rewards are recalculated and distributed retroactively from the last completed calculation, ensuring that no rewards are lost or left undistributed.

In essence, Merkl is the engine behind most DeFi rewards, combining complex onchain computation with automated distribution to provide precise tracking of individual user earnings.

For protocols

Merkl functions as a smart contract–aware engine, orchestrating onchain reward computation, verification, and distribution.

As the core of its operation is the Merkl Distribution Creator contract, which web3 projects use to set up campaigns. This contract provides the Merkl Engine with the campaign configuration, including eligibility criteria, reward structures, and distribution methods, and pushes all these details onchain along with the token reward to be distributed. When users interact with a protocol to earn rewards or points, the Merkl Engine fetches the campaigns from the Distribution Creator contract, computes reward allocations based on the encoded rules, and executes the distribution.

Merkl includes a built-in dispute process to safeguard reward distribution. For one hour after each reward update, protocols or users can challenge any allocation made by the Merkl Engine, ensuring integrity before rewards become final and claimable. Disputes are submitted via a disputeToken to the Merkl Distributor contract, pausing the campaign until resolved, while automated dispute bots help block any malicious attempts.

Additionally, Merkl exposes a robust API with real-time access to all Merkl data, including rewards, APRs, Merkle proofs, and analytics. This allows protocols to embed live reward information and enable claiming directly in their interface, as implemented by Aave, Uniswap, Euler, and Morpho.

Conclusion

In essence, Merkl is more than a reward distribution platform: it is the technical backbone of DeFi incentives.

For users, it turns everyday interactions with protocols into tangible rewards, simplifying yield farming, liquidity provision, lending, and other onchain activities.For web3 projects, it offers a smart contract–aware engine, an intuitive campaign management system (Merkl Studio), strong visibility among DeFi users thanks to the high traffic of the Merkl App, and a real-time API for seamless integration across various DeFi apps.

By combining automation, transparency, and flexibility, Merkl ensures that reward distribution is accurate, fair, and scalable across multiple chains. Whether you are a casual DeFi participant or a protocol managing complex incentive campaigns, Merkl provides the infrastructure to bridge engagement and incentives, creating a more connected and rewarding DeFi ecosystem.